The revolving door of financial oversight spins again. Abby Thomas, the chief executive of the Financial Ombudsman Service (FOS), has unexpectedly stepped down, barely two years into the job. The timing? Impeccable. Just days after the government’s review on redress reform closed on January 30th. Coincidence? Unlikely.

A Convenient Departure

Thomas, who took the helm of FOS in October 2022, also served as chief ombudsman. But now, like so many before her who’ve stood between consumers and the unchecked ambitions of the City, she’s out. She departs with the usual platitudes about “rapid transformation and innovation” and “building confidence in financial services.” One can only wonder whether she jumped or was nudged—perhaps by a well-manicured Downing Street hand.

Stepping in to hold the fort are Deputy Chief Ombudsman James Dipple-Johnstone and Chief Finance and Risk Officer Jenny Simmonds. But let’s not kid ourselves—these are just new faces for an institution under siege.

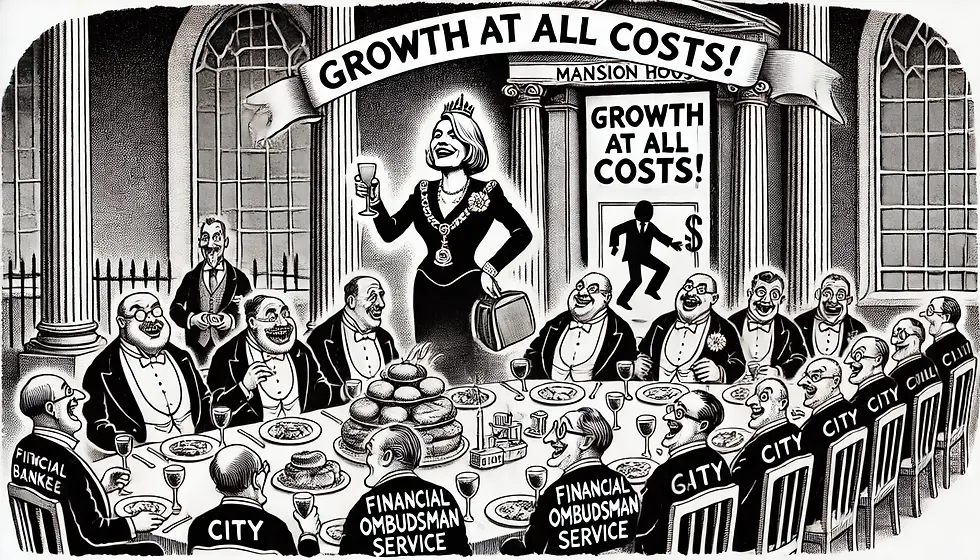

The Chancellor’s Mansion House Decree

It was only in November 2024 that Chancellor Rachel Reeves took to the gilded halls of Mansion House, addressing an audience of bankers who, no doubt, enjoyed a fine meal at the taxpayer’s expense. Reeves didn’t mince words: reform was coming. But not the kind that protects consumers—oh no. The goal, she declared, was to make Britain “a surer climate for investment.”

Translation? FOS was to go easier on financial firms. Less scrutiny. Fewer payouts. Fewer consequences. A green light for the City to do what it does best: profit, regardless of the fallout.

The Review That Sealed the Deal

To make it all look respectable, a “joint call for input” was launched by FOS and the Financial Conduct Authority (FCA), closing on 30th January. The industry, of course, had its say—likely behind closed doors, in meetings well away from public scrutiny. Consumers? Well, their role in this grand exercise in regulatory theatre remains unclear.

And now, before we even hear the official findings, the head of the FOS is gone. How terribly convenient.

A Pattern of Sacrificial Lambs

Let’s not pretend this is an isolated event. Thomas is just the latest casualty of the government’s relentless push for ‘growth at all costs’—and by ‘growth,’ we mean more profit for banks, hedge funds, and asset managers.

We’ve seen it before. When the regulators don’t play ball, heads roll. Any resistance to Whitehall’s pro-City agenda is swiftly neutralised. This isn’t about reforming redress. It’s about neutering oversight so that financial institutions can operate with impunity.

What Happens Next?

The results of the review will be announced later this year, but the direction of travel is already clear. Expect fewer obstacles for financial firms, a more ‘business-friendly’ approach to consumer complaints, and a system tilted ever further in favour of the industry.

Meanwhile, the people who rely on the FOS—the ordinary consumers mis-sold, misled, or outright defrauded—will likely find their paths to justice increasingly blocked.

So, let’s not pretend Abby Thomas’s exit was just an ‘unexpected’ leadership change. It was a message: get in line, or get out.

Comments