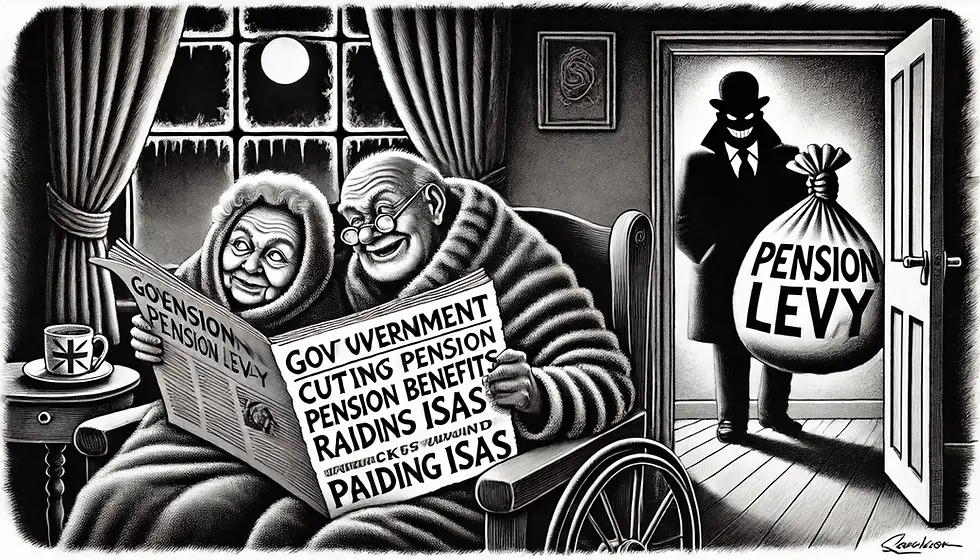

First, they take a scalpel to winter fuel allowances, subjecting them to the ignominy of means-testing. Then, they toy with the notion of levying death duties on inherited pensions, a concept that surely sends shivers down the spines of those who once believed in the sanctity of prudent saving. And now, in their latest act of fiscal vandalism, they contemplate a raid on cash ISAs, the last bastion of financial security for retirees who wish to shield their life savings from the capricious whims of the stock market. One cannot help but ask: what has this government got against pensioners?

The latest wheeze, spearheaded by Rachel Reeves, reveals a brazen willingness to plunder the modest nest eggs of those who have spent a lifetime accumulating them. With the Treasury’s coffers resembling Old Mother Hubbard’s cupboard, the Chancellor finds herself under mounting pressure to wring every possible penny from the public purse. The latest suggestion? A wholesale assault on ISAs, ostensibly to ‘encourage investment’—though one strongly suspects the real motive is rather more prosaic: an insatiable appetite for revenue.

Consider the hubris of it all. Cash ISAs, long regarded as the prudent saver’s refuge, are now in the crosshairs. The rationale? That the government needs to "drive an investment culture." As if pensioners, many of whom recall the misadventures of the dot-com bubble, the financial crisis, and other assorted market calamities, would be best served by trading in their safe, tax-free savings for a chance to gamble in the stock market.

Then there is the proposed annual limit reduction. Currently set at a mere £20,000—frozen since 2016—it is already an outdated pittance when compared to inflation and real wages. But Reeves and her cohorts are reportedly mulling a cut to this allowance, presumably in the belief that anyone who can scrape together such a sum is sufficiently well-heeled to be taxed with impunity. One City analyst, with breath-taking condescension, remarked that reducing the allowance "won’t upset their voter base," as the working class supposedly has no means to save such amounts. How reassuring.

And let us not forget the potential for a lifetime ISA limit—an even more egregious violation of the principles of long-term saving. In a 2016 article, Reeves herself floated the idea of capping ISAs at £500,000, though one suspects that, under the current administration, such a ceiling would be far lower. If implemented, a lifetime limit would not only punish those who have diligently saved but would also introduce yet another layer of bureaucratic complexity, as individuals scramble to restructure their savings to avoid punitive taxation.

But perhaps the most galling proposal of all is the potential demise of the cash ISA altogether. Imagine: a financial instrument designed to protect one’s savings from both taxation and market volatility, abolished at the stroke of a Treasury pen. Why? Because, in the eyes of the government, parking one's money safely, rather than subjecting it to the slings and arrows of market fluctuations, is now a social ill requiring legislative correction.

The paternalistic undertone of these proposals is striking. The government, in its infinite wisdom, believes it knows better than the individual how one should manage their finances. The mere fact that millions of Britons have opted to store their wealth in cash ISAs is seen not as an expression of rational decision-making but as a problem requiring correction. We are to be ‘encouraged’—or rather, coerced—into funnelling our savings into equities, where they may be taxed and traded to the benefit of the financial elite.

It is, of course, unsurprising. The notion that the government might tighten its own belt before raiding the piggy banks of pensioners is laughably naïve. Instead, those who played by the rules—who saved diligently, spent prudently, and sought only to preserve their wealth without unnecessary risk—must bear the burden of fiscal shortfalls caused by reckless spending and economic mismanagement.

And so, pensioners find themselves yet again in the firing line. First their heating allowance, then their pension inheritance, and now their hard-earned savings. One might almost suspect that this government wishes to make old age as precarious as possible. But perhaps that is the point. After all, those without savings are far easier to control.

Yorumlar